Why Invest in Bonds

A client recently passed his local bank and noticed an advertisement for a 9-month CD paying 5.3%. Rates haven’t been that high in quite a while, he thought, and he wondered if it might make sense to move some money from bonds to CDs.

And for understandable reasons. CDs are generally safer than bonds, which have had awful returns for the past few years. Why risk money in bonds when you could safely earn over 5%?

Although it’s true that CD yields have become relatively attractive over the past year, it’s worth considering the role bonds play in a long-term portfolio, and that shifting to short-term cash investments like CDs may come at a cost to your long-term goals.

The Role of Bonds

The main reason we own bonds in a portfolio is to counteract the risk of stocks while providing some return. Using sailing as an analogy, stocks are like the wind in your sails that propels you forward, while bonds are like the ballast that keeps your boat from capsizing in high winds.

The reason bonds tend to counteract the risk of stocks is that they are fundamentally different securities. Bonds are essentially loans to corporations and governments, while stocks are ownership stakes in companies. Corporate bonds are higher on the capital structure than stocks, which means if a company goes bankrupt bondholders get paid first. Government bonds including municipals are considered among the safest bonds given the credit worthiness of their issuers.

As a result, bonds tend to be more stable and exhibit a low correlation with stocks, meaning their price movements tend to be less aligned with the gyrations of the stock market. This tendency for bonds to zig when stocks zag can be especially helpful when stocks fall.

Often, But Not Always

There are years, however, when bonds don’t fulfill their role as a shock absorber to stocks, like we’ve seen in 2022. Not only were bonds down along with stocks for the year, 2022 was the worst year on record for bonds with the Bloomberg U.S. Aggregate Bond Index falling 10.5%.

Why such an awful year? 2022 was a perfect storm for bonds. Interest rates were at their lowest in decades, and the Fed aggressively raised interest rates to combat high inflation. When interest rates rise, existing bonds paying lower interest rates become less attractive. As a result, prices on existing bonds fell dramatically, and so did the stock market on concerns about the economy.

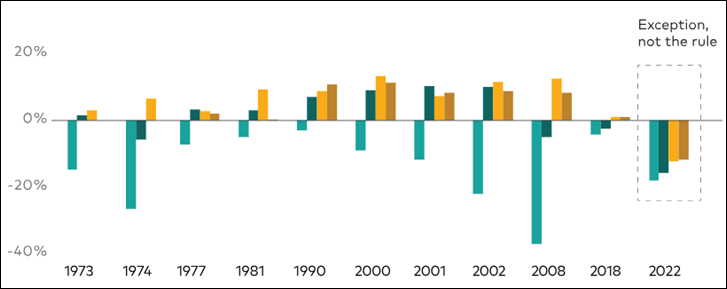

Fortunately for investors, years like 2022 have been the exception, not the rule for bonds. Looking back over the last 50 years, bonds have delivered meaningful diversification benefits, especially in down years for stocks, as illustrated in this chart from Vanguard.

Exhibit 1: Years With Negative Stock Returns: 1973 to 2022

Notes: U.S. equities represented by the S&P 500. U.S. corporate bonds represented by the Bloomberg US Corp Bond Index. U.S. government bonds represented by the Bloomberg US Government Index. U.S. mortgage-backed bonds represented by the Bloomberg US MBS Index. Data for U.S. mortgage-backed bonds begins in 1976 and is not included in the 1973 and 1974 periods. Past performance is no guarantee of future results. The performance of an index does not represent any particular investment, as you cannot invest directly in an index.

Source: Vanguard calculations using data provided by Morningstar as of June 30, 2023.

It may be tempting to reduce your allocation to bonds after a year like 2022 and wait for a better time to invest in bonds. But there are other factors to consider before making short-term changes to a long-term strategy.

Self-Healing Wounds

While rising interest rates hurt bond prices in the short term, portfolios of bonds including bond mutual funds tend to benefit from higher rates over time.

That’s because as existing bonds mature, proceeds can be invested at higher rates. This “self-healing” mechanism, as Morningstar points out, can make up for earlier losses, leaving long-term investors in bond funds better off in the long run, which is contrary to the way most people look at bonds.

Investors can think of this tradeoff as a pit stop in a Formula 1 race. The stop causes the driver to fall back, but fresh tires and a top-up of fuel can help the driver win the race if there are enough laps to catch the leader.

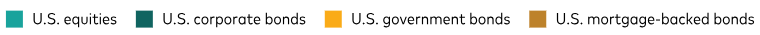

Exhibit 2 illustrates this tradeoff by comparing two hypothetical scenarios. The blue line shows the actual performance of the Bloomberg U.S. Aggregate Bond Index from February 1, 2022 through September 30, 2023, and then assumes that its yield remains constant at 5.39% going forward. The brown line assumes rates never moved and the yield remains constant at 2.33% for the full duration.

Exhibit 2: Rising Yields Can Lead to Higher Returns Over the Long Term: Hypothetical Cumulative Returns

Source: Vanguard. Cumulative returns assume that income is reinvested with no changes to prices. This hypothetical illustration does not represent the return on any particular investment and the rate is not guaranteed.

In the first scenario returns suffer short term, but cumulative returns catch up to the second scenario in seven years, illustrating that while higher rates may negatively impact bond prices initially, higher yields can be beneficial to bond investors over the longer term.

Performance of Bonds vs. CDs

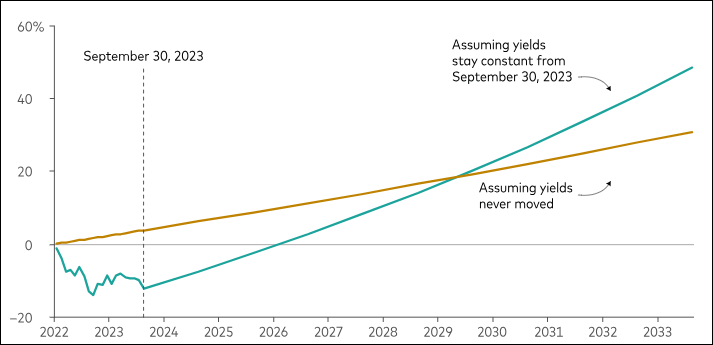

Another reason to stick with bonds as part of a balanced portfolio is that bonds have provided better returns than short-term cash investments such as CDs over long periods.

Since 1976, bonds have returned an annualized 6.8% vs. 5.1% for 12-month CDs. And as illustrated in Exhibit 3, bonds have performed even better following peaks in interest rates, returning 12.5% annually in the 3 years following rate peaks compared to 7.1% for 12-month CDs.

Exhibit 3: 3-Year Annualized Returns Following Peak Years in the Federal Funds Rate – 1976 to 2022

Notes: Bonds represented by Bloomberg U.S. Aggregate Bond Index. CDs represented by national deposit rates for 12-month CDs. Past performance is no guarantee of future results. The performance of an index does not represent any particular investment, as you cannot invest directly in an index.

Sources: Mendham Wealth Partners calculations using data from Bloomberg and the Federal Reserve Bank of St. Louis.

Conclusion

Nobody can predict the future of interest rates or how bonds will perform over the next several years. But if history is a guide, the odds of bonds resuming their role as shock absorber to stocks are very good, and today’s higher yields support an improved outlook for bond returns going forward. Cash-related investments like CDs and money markets are great options for short-term savings and spending needs, but when it comes to asset allocation it’s worth considering the benefits bonds can bring to a long-term diversified portfolio.