Presidential Elections and the Stock Market : October 5, 2016

As American's get ready to go to the polls next month, many investors are concerned about what the election could mean for their portfolios. Clients often ask us "which candidate will be better for the market?" and "should I lighten up on stocks until after the election?" Well, as John Bogle, founder of Vanguard says, often the best advice to investors is "don't just do something, stand there!" Even if you feel strongly about one party or the other when it comes to politics, when it comes to your portfolio, it tends not to matter which party wins the Oval Office.

The narrative I often hear is that Republican presidents are better for the stock market because they are more business-friendly than Democrats. However, the body of analysis on this is inconclusive. Just Google the topic and you’ll find numerous contradictory studies. It all depends on the time period you select, whether you are comparing just election years vs. the full time a president is in office, and whether you comparing nominal returns or so called “excess returns” (basically return of the stock market minus what you would earn in T-bills or the bank). The reality is that you can pick data that supports almost any narrative, but if you take a more objective look at history you'll find much less predictability than media pundits suggest.

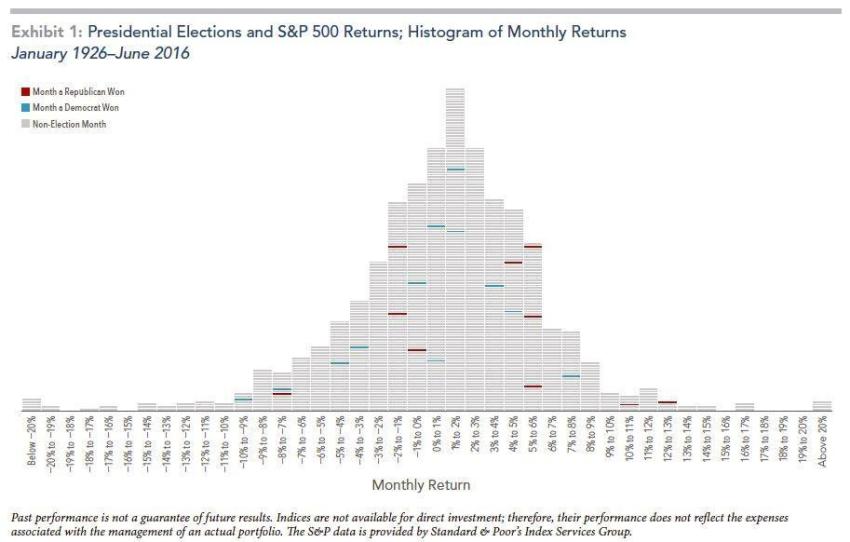

Here are two charts from Dimensional Fund Advisors that illustrate the relative unpredictability of stock market performance following elections. Exhibit 1 shows the frequency of monthly returns (expressed in 1% increments) for the S&P 500 Index from January 1926 to June 2016. Notice how randomly distributed the red and blue dashes appear, indicating very little correlation of market returns to election results.

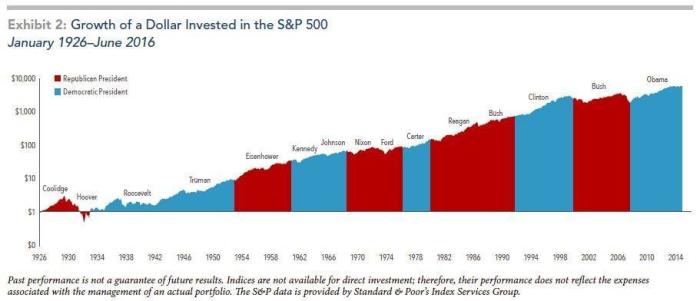

Exhibit 2 shows the growth of one dollar invested in the S&P 500 Index over nine decades and 15 presidencies (from Coolidge to Obama). Do you seen any pattern of stock market performance based upon which party holds the Oval Office?

History shows how difficult if not impossible it is to make a predictable connection between elections and the stock market, whether it’s over the short or long term. Granted, this election will be like no other in our history, but it doesn't change our advice to long term investors: you are best served by tuning out the media noise and resisting the temptation to make changes to your investment plan based on predictions around the elections. At best, any positive outcome based on such predictions will likely be the result of luck. At worst, it can lead to costly mistakes.